Credit Scoring System Using Python AI ML

10 in stock

A Credit Scoring System is an application that evaluates the creditworthiness of individuals or entities using machine learning and artificial intelligence techniques. The system predicts the likelihood of a borrower defaulting on a loan based on their financial history and other relevant factors.

₹10,325.00 ₹12,390.00 (Incl. GST)

10 in stock

Credit Scoring System Using Python AI/ML Project

A Credit Scoring System Using Python AI ML is an application that evaluates the creditworthiness of individuals or entities using machine learning and artificial intelligence techniques. The system predicts the likelihood of a borrower defaulting on a loan based on their financial history and other relevant factors.

Key Features:

- Credit Risk Prediction: Predicts the risk of credit default using historical data and financial indicators.

- Scoring Model: Implements a scoring model that assigns a credit score based on various features and inputs.

- Data Analysis: Analyzes financial data to determine key factors affecting creditworthiness.

Technologies Used:

- Python Libraries:

pandas: For data manipulation and analysis.numpy: For numerical operations and data processing.scikit-learn: For machine learning algorithms and model evaluation.matplotlib/seaborn: For data visualization and understanding patterns.tensorflow/keras(optional): For advanced deep learning models if needed.

Implementation Steps:

- Data Collection: Gather historical financial data, including features such as income, credit history, loan amount, repayment history, etc. This data is typically sourced from financial institutions or publicly available datasets.

- Data Preprocessing: Clean the data to handle missing values, outliers, and ensure consistency. Perform feature scaling and encoding to prepare the data for machine learning models.

- Feature Selection: Identify and select relevant features that significantly impact creditworthiness. This could involve statistical analysis and domain knowledge.

- Model Selection and Training:

- Choose Algorithms: Select appropriate machine learning algorithms such as logistic regression, decision trees, random forests, or gradient boosting.

- Train Models: Train the selected models on the historical data to learn patterns and make predictions.

- Model Evaluation:

- Validation: Use techniques like cross-validation to assess the performance of the models.

- Metrics: Evaluate the models using metrics such as accuracy, precision, recall, F1-score, and ROC-AUC to determine their effectiveness.

- Deployment:

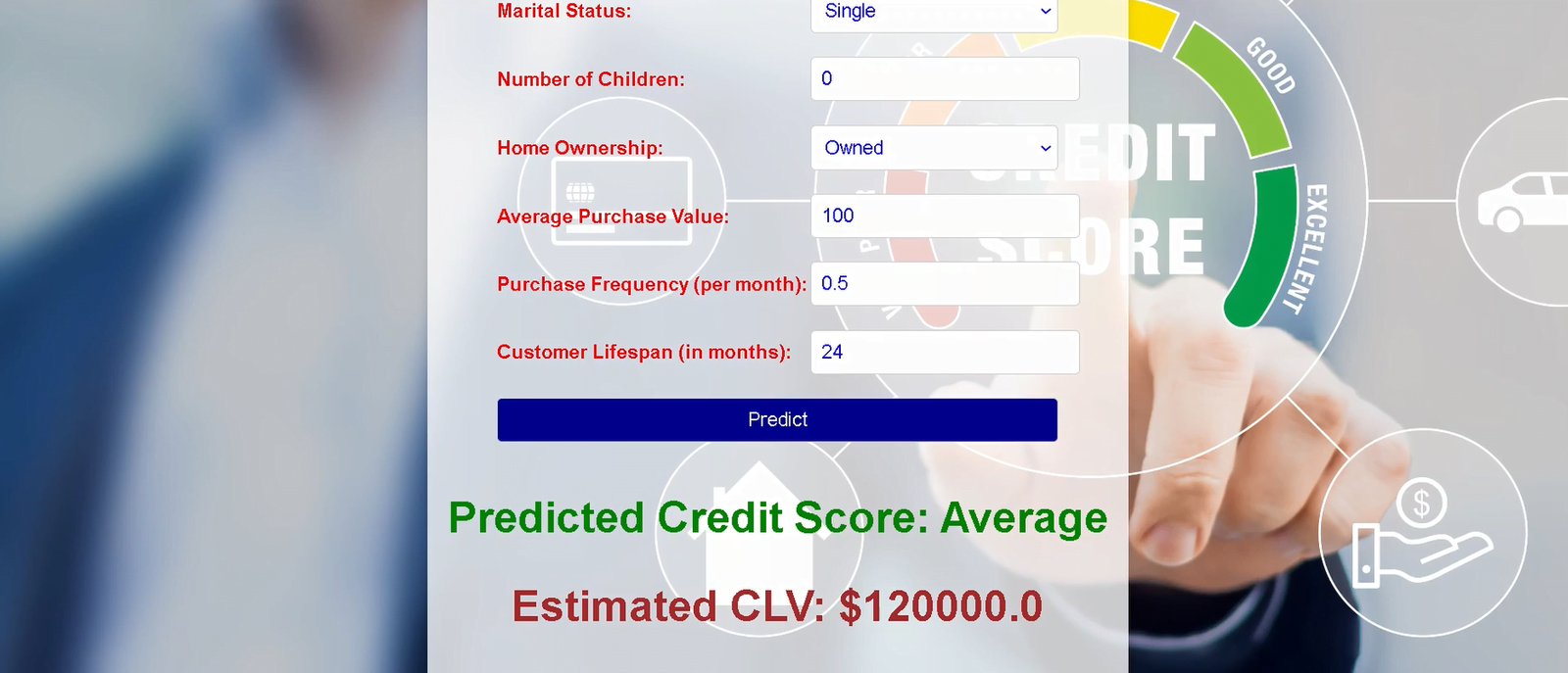

- Integration: Integrate the trained model into a software application or web service where it can take user inputs and provide credit scores.

- User Interface: Develop a user-friendly interface to allow financial analysts or loan officers to input data and receive credit scores.

- Continuous Improvement:

- Monitoring: Continuously monitor the system’s performance and update the model with new data to improve accuracy.

- Feedback Loop: Implement feedback mechanisms to refine the model based on real-world outcomes and user feedback.

Benefits:

- Enhanced Decision-Making: Provides a data-driven approach to assess credit risk, leading to more informed lending decisions.

- Efficiency: Automates the credit scoring process, reducing manual effort and errors.

- Risk Management: Helps in identifying high-risk borrowers and mitigating potential losses.

Use Cases:

- Financial Institutions: Banks and lending agencies use the system to evaluate loan applications and determine creditworthiness.

- Insurance Companies: Assess the risk profile of clients seeking insurance coverage.

- Credit Agencies: Provide credit scores and reports to individuals and businesses for financial planning.

By leveraging Python’s machine learning capabilities, the Credit Scoring System project enables accurate and efficient credit risk assessment, facilitating better financial decision-making and risk management.

| Weight | 0.00 kg |

|---|---|

| Dimensions | 0.00 × 0.00 × 0.00 cm |